Authorize.Net vs QuickBooks

March 15, 2025 | Author: Sandeep Sharma

10★

Authorize.Net provides payment solutions that save time and money for small- to medium-sized businesses and organizations. Accept credit cards and electronic checks securely and easily from your website. Solutions range from simple Buy Now buttons to more sophisticated subscription and tokenized payment products.

44★

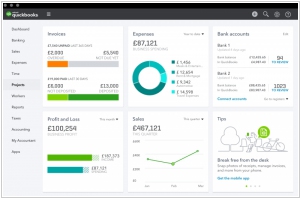

QuickBooks puts you in control of your finances, your time, your business—and where you work. From setup to support, QuickBooks makes your accounting easy. With simple tools to get you started, free support, and a money-back guarantee, QuickBooks is the effortless choice.

Authorize.Net and QuickBooks have a lot in common, which is surprising given that one spends its time processing payments and the other pretends to enjoy accounting. Both can handle transactions without throwing a fit, integrate with various software like a well-trained but slightly bored butler and offer fraud protection in case anyone tries to pay for a yacht with Monopoly money. They also let businesses set up recurring billing, which is a fancy way of saying "automated nagging for money," and are beloved by small businesses that don't want to manually type out invoices while crying into their tea.

Authorize.Net, born in 1996 in the vast, sprawling landscape of American commerce, is a dedicated payment gateway that takes its job very seriously. It doesn’t want to balance books, track expenses or calculate tax deductions—it just wants to process payments and go home. It works best for online shops, retail businesses and people who want to accept digital wallets without knowing what they are. It also accepts e-checks, because some people still like to pretend paper is a viable way to exchange money in the 21st century.

QuickBooks, on the other hand, has been around since 1983 and originates from the same land of opportunity and confusing tax codes. It was designed for small business owners, freelancers and anyone who thinks spreadsheets are a form of modern poetry. It doesn’t just process payments—it also tracks expenses, handles payroll and tries very hard to convince you that tax season isn’t a terrifying black hole of despair. While it can process payments, that's more of a side gig; its real passion lies in bookkeeping, which is a phrase that excites some people for reasons no one fully understands.

See also: Top 10 Payment Processing platforms

Authorize.Net, born in 1996 in the vast, sprawling landscape of American commerce, is a dedicated payment gateway that takes its job very seriously. It doesn’t want to balance books, track expenses or calculate tax deductions—it just wants to process payments and go home. It works best for online shops, retail businesses and people who want to accept digital wallets without knowing what they are. It also accepts e-checks, because some people still like to pretend paper is a viable way to exchange money in the 21st century.

QuickBooks, on the other hand, has been around since 1983 and originates from the same land of opportunity and confusing tax codes. It was designed for small business owners, freelancers and anyone who thinks spreadsheets are a form of modern poetry. It doesn’t just process payments—it also tracks expenses, handles payroll and tries very hard to convince you that tax season isn’t a terrifying black hole of despair. While it can process payments, that's more of a side gig; its real passion lies in bookkeeping, which is a phrase that excites some people for reasons no one fully understands.

See also: Top 10 Payment Processing platforms